The COVID-19 pandemic exposed weaknesses in the US and Mexican supply chains for pharmaceuticals, medical devices, and personal protective equipment (PPE). The reliance on imports of active pharmaceutical ingredients (API) and finished products, including from China and India, placed our countries in a vulnerable, and previously underappreciated position. However, shortages of these critical products, some of which continue today, underscore the risk of relying on a single country or pair of countries. Pandemic quarantines led to production reductions. Transportation delays exacerbated shortages. Anticipating and planning for interruptions, as is occurring with semi-conductors and critical minerals, should also be applied to pharmaceuticals. It is not likely that the United States and Mexico can replace Chinese and Indian production of pharmaceutical ingredients or finished medicines, nor is that necessarily desirable. However, the diversification of supply through increased production in Mexico and the United States offers obvious advantages should future pandemics or geopolitical circumstances impede supplies from Asia. Ensuring a more diverse supply chain will require specific government policies and industry actions.

In 2021 the Biden administration identified pharmaceuticals as a vital supply chain. In July of that year, Executive Order 14001 established a National Strategy for a Resilient Public Health Supply Chain led by the Departments of Homeland Security, Defense, Health and Human Services, and Veterans Affairs. The strategy seeks to mitigate risk by expanding the industrial manufacturing base, which includes collaborating with international partners and geographic diversification. Congress has focused not on the finished pharmaceuticals, but the active ingredients that give drugs their desired effects.

This paper provides a primer on the issues underlying the need to strengthen the pharmaceutical supply chain in the United States and Mexico. It highlights the importance of sustained policy action prior to another interruption to the medication supply chain. Strengthening the medicinal supply chain in North America provides benefits beyond simply diversifying supply, such as the opportunity for Mexican and US manufacturers to take advantage of the current near-shoring trend which is drawing investment and jobs back to North America from Asia and to exercise greater oversight over the movement and utilization of chemicals which often have multiple uses, not all of which are licit. Finally, supply chains for innovative and generic medicines differ, with the former more resilient. As such, this paper (and current policy discussions) focuses primarily on generics which represent over 90% of the prescriptions dispensed in the United States and in Mexico.

Active Pharmaceutical Ingredients and their Context

Active pharmaceutical ingredients (APIs) are the components in a small molecule (or chemical) drug that produce the required effect on the body to treat a condition. These ingredients, such as acetaminophen or atorvastatin, are produced by processing chemical compounds. In a biologic drug, the active ingredient is known as a bulk process intermediate. Key Starting Materials, or KSM, are the raw materials used in the production of an API; little KSM manufacturing takes place in the United States, and the US government has limited information about KSM supply chains due to confidentiality practices.

APIs are broadly categorized into two types: synthetic and natural. Synthetic APIs are further categorized as innovative and generic synthetic APIs, based on the type of synthesis used. Synthetic chemical APIs, also known as small molecules, are used to produce numerous commercially available small molecule drugs and represent a large part of the pharmaceutical market. Natural APIs are used to produce biologic drugs, of which there are currently far fewer.

The global pharmaceutical API market will grow from $206.95 billion in 2023 to $219.76 billion in 2024 at a compound annual growth rate (CAGR) of 6.2% and is expected to reach $279.03 billion in 2028 at a CAGR of 6.2%.

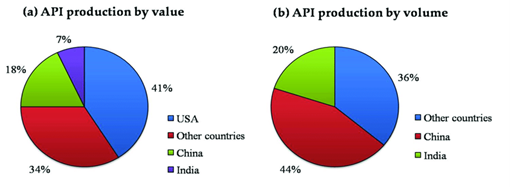

Despite current interest in medicines manufacturing, the US remains heavily dependent on active pharmaceutical ingredients (APIs) supplied from overseas, with more than 60% sourced from just two countries: India and China. Currently 48% of APIs are imported into the US are from India, and 13% are from China while just 10% of APIs, produced by three manufacturers, are made domestically. The concentration of API production also means that many final drug manufacturers source their API from the same entity which has the potential to create critical choke points. Notably, although imports of Chinese APIs have grown by around 24% since 2020, the portion of all imports of APIs have remained flat since 2018.

Drug Master Files

In addition to Indian and Chinese dominance in API production, India is the overwhelming source of new drug master files to the FDA. A drug master file is a voluntary submission to the FDA which provides information on the facilities and operations of the manufacturing, processing, and storing of one or more drugs meant for human consumption. India contributed 62% of active API drug master files, or DMFs, submitted in 2021, up from 20% in 2000. This increase is consistent with the country’s well-publicized national ambition to enhance API manufacturing capabilities. Meanwhile, Europe’s contribution declined from 49% of active API DMFs filed in 2000 to 7% filed in 2021. China contributed 18% of new API DMFs filed in 2019, and 23% filed in 2021. The United States contributed 4% of new API DMFs filed in 2019 and 2021.

Mexico’s Pharmaceutical Market

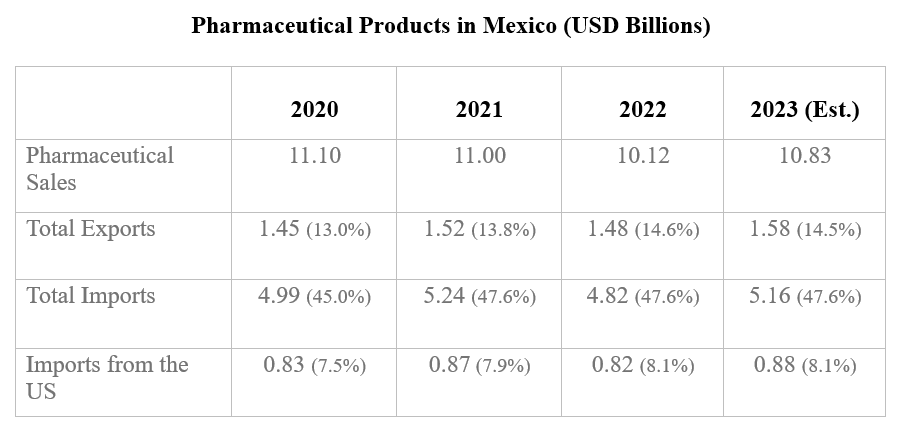

In Latin America, Mexico’s pharmaceutical market is second only to Brazil with a 2020 value of more than $7 billion US, compared to the $20 billion for the Brazilian market. The sector relies mostly on imports, although presently 138 pharmaceutical manufacturing facilities operate in the country. Mexico’s regulatory body, COFEPRIS (for its acronym in Spanish) reports that generics represent more than 80% of the market’s volume.

"Approximately 400 laboratories manufacture pharmaceuticals in Mexico, mostly in the Mexico City metropolitan area, as well as in the states of Jalisco, Mexico, Puebla, and Morelos. The Mexican pharmaceutical industry stands out because it is home to 20 out of the 25 largest companies worldwide."

The United States is still the largest foreign supplier of pharmaceutical products to the Mexican market. In 2023, the United States exported $2.67 billion. Like the United States, Mexico is also heavily reliant on China for APIs. Mexican pharma imports to the US exceed $2.5 billion but this represents only 1.5% of the $345 billion market; Mexico ranks 16th among the US’ API suppliers.

The Government of Mexico has consistently sought to promote greater usage of generic pharmaceuticals in Mexico. This could reduce the long-term market size for protected (single sourced) medications in the country.

To fully understand potential expansion of pharmaceutical production in Mexico, it is important to understand how Mexico (and the United States) fit into the global market.

Extra-Regional Production

India

India’s active pharmaceutical ingredients market had an estimated value of $19 billion in 2021 with an expected compound annual growth rate of 8.3% from 2021-2028. India is the largest exporter of pharmaceutical APIs in the world with most of its production exported to Bangladesh, Turkey, and Brazil.

India has embarked on an ambitious plan to cut dependence on China for key starting materials (KSMs), intermediates, and APIs to support its effort to become the self-sufficient “pharmacy of the world.” At present, however, India’s $42 billion pharmaceutical sector is heavily dependent on China for KSMs and APIs. Estimates put India’s dependence on China at as much as 90% for certain drugs. Indian drug-makers import more than 80% of their total APIs from China.

Aware of its dependence on China, in 2020 the Indian government announced a $1.3 billion incentive program to increase manufacturing and build resilience in the pharmaceutical value chain. The program includes a Production Linked Incentive (PLI) scheme for manufacture of identified KSMs/intermediates/APIs which offers sales-based financial incentives of 5-20% for selected manufacturers of 41 products covering 53 identified APIs for up to six years.

China

China’s API industry plays a dominant role in the global pharmaceutical sector due to its industrial infrastructure, large scale manufacturing capability of raw materials, and relatively low labor and materials costs. Some estimates suggest that production costs in China are 20-30% lower than in India.

Some studies suggest up to 80% of the basic ingredients in US drugs come from China, which according to the Food and Drug Administration is also the second largest exporter of biologics and the prime source of medical devices. Even in cases, such as generic drugs, where India appears to be the primary source, India is dependent on China for most of its KSMs and APIs.

According to the China Chamber of Commerce for Import & Export of Medicine and Health products in 2019, APIs produced and exported by China reached 10.12 million tons (+9% year-on-year), worth $33.7 billion (+12% year-on-year). The destinations of APIs produced and exported by China comprise 189 countries and regions, mainly in Asia, Europe, and North America. In essence, the Chinese API industry plays an important role in global pharmaceuticals and produces around 40% of API global exports, including some of the most important such as paracetamol and acetylsalicylic acid.

Why Expand Alternative Sources and Enhance Resilience?

The concentration of manufacturing of APIs, KSM, and final products in a small number of manufacturing facilities poses significant risks to patient access to medicine. Facilities can be closed, or production interrupted due to failure to pass regulatory inspections, bankruptcy, or natural disasters. Using predictive models, US Pharmacopeia (USP) forecasts drug shortages and frequently finds that production concentration is a key factor. Looking at 20 oncology products, for example, USP found that 40% of their production was concentrated in a single facility, and that several of these drugs are used as substitutes for each other. Further, many final drug manufacturers source their API from the same entity which creates a critical choke point. Of the 102 products for which a single supplier holds a market share equal to or greater than 75%, 32 are from China, 15 from India, and only 1 from Mexico. Therefore, reducing the US and Mexican dependence on imported APIs and finished medications from India and China, and strengthening the regional pharmaceutical production market would yield significant benefits.

Domestic production would reduce the risk inherent in dependence on imports from Asia. The disruptions caused by the COVID-19 pandemic, including reductions in production due to quarantines and lack of adequate container space on transoceanic ships, underscore the risk of dependence on Asian production. The obligation to develop a more resilient supply chain is an essential lesson of the pandemic. Disruptions are also caused by geopolitical developments, as evidenced by grain supply disruptions caused by Russia’s invasion of Ukraine. Belligerent actions in Asia would very likely impact the movement of goods across the Pacific even if production in Asia were not impacted. Limitations on the export of certain chemicals, in response to complaints about lax controls of fentanyl production, cannot be ruled out, even if there is no indication of such a policy at this time. Additionally, the BIOSECURE Act, introduced into the US Congress in January 2024, would prohibit companies receiving federal grant money from working with four named Chinese firms and their subsidiaries. Passage of the act would require several US manufacturers to identify alternative suppliers for essential ingredients.

Increased production of API and finished medications in Mexico and the United States would also contribute to enhanced safety and regulatory cooperation between the US FDA and Mexico’s COFEPRIS. The two agencies already collaborate to enhance their efficiency and improve their ability to ensure the safety of medicine in their respective countries. Both agencies conduct inspections of manufacturing facilities around the world. When a facility is found deficient in one or more areas, production is halted until the deficiency is remedied. Recent examples in India and in North Carolina demonstrate that these impediments to production can occur anywhere, and for manmade or natural reasons. Increased production from diverse facilities would reduce the impact of plant closures. Further, increased production in Mexico and the US would provide additional opportunities for the regulators to collaborate on joint inspections and application reviews for regulatory approval.

The US Department of Defense (DOD) has become increasingly concerned with the risks to the pharmaceutical supply chain and its ability to obtain medicines for its personnel. Language in several appropriations bills currently under consideration in the Congress calls for, among other things, creation of working groups to report on supply chain shortages and public-private partnerships for advanced manufacturing of APIs. Increased production in Mexico or the United States would address many of the concerns raised by DOD.

According to the Food and Drug Administration, approximately 72% of active pharmaceutical ingredients used in the US drug supply are manufactured in more than 150 countries, with 13% coming from China. On April 26, 2023, Representatives Matt Cartwright (D-PA), Earl L. "Buddy" Carter (R-GA), Darren Soto (D-FL), and Carol Miller (R-WV), reintroduced a bill to make the US pharmaceutical supply chain less dependent on China and other foreign adversaries. The Manufacturing API, Drugs, and Excipients (MADE) in America Act will work to mitigate drug shortages and medical supply chain interruptions while incentivizing domestic manufacturing of drugs, API, PPE, and diagnostics.

The report of the House Select Committee on the Strategic Competition between the United States and the Chinese Communist Party, “Reset, Prevent, and Build: A Strategy to Win America’s Economic Competition with the Chinese Communist Party,” identifies US dependence on the People’s Republic of China (PRC) as a “distinct national security risk.” The report also calls for “focusing first on two additional areas where America has an obvious and unacceptable dependency on the PRC: critical minerals and active pharmaceutical ingredients (APIs).”

At present, cost structures for pharmaceutical manufacturing, as described previously, provide Asian manufacturers with a competitive advantage. It is possible that increased production in Mexico and the United States could lead to more competitive pricing. Government incentives, some of which are discussed below, could enhance domestic competitiveness for API and finished products.

Finally, many of the precursor chemicals used to produce synthetic opioids and other illicit drugs have a dual, legitimate purpose. Increasing production of APIs in Mexico and the United States would enhance both countries’ ability to monitor and control the trade of precursor chemicals. Fentanyl, a drug responsible for nearly 75,000 deaths in 2023 in the United States, has legitimate medicinal uses but is also produced for illicit use and trafficked from Mexico. Precursor chemicals and APIs are shipped from China and India, along with billions of dollars of other products passing through Mexican ports. These trade flows make it exceedingly difficult to effectively monitor the recipients and their use of the imported product. Increased API production in Mexico would allow for the creation of a monitoring and inspection system that, if properly implemented, could reduce diversion into illicit production.

Pharmaceutical Manufacturing Incentives in the United States and in Mexico

Both the US and Mexican governments offer a panoply of incentives and supporting measures to strengthen their industries.

United States

US spending on pharmaceuticals increased from $253 to $345 billion from 2000-2019. Given the demographic projection for a marked increase in an aging population, one can expect an even greater trajectory of health-related spending over the next several decades.

Tax credits are an important incentive for the pharma sector. To illustrate, the Domestic Medical and Drug credit allows a deduction of 10.5% of the net income from the sale of a medical product. This effectively cuts the corporate tax rate of 21% in half on these domestically manufactured products.

Recent legislative changes have allowed companies large and small to take advantage of the IRS tax code’s Section 41 R&D credit which provides an incentive for companies to invest in the domestic development of new or improved products, processes, or software. The credit provides federal and state tax benefits ranging from 6% to 13% of every incremental development dollar spent and reduces tax liability on a dollar-for-dollar basis. Eligible qualified small businesses may use the credit to offset the employer portion of payroll taxes.

The innovative biopharmaceutical industry trade group, Pharmaceutical Researchers and Manufacturers of America (PhRMA) also has proposed a reduced tax rate on US manufacturing income generated from producing pharmaceuticals and medical devices in the US Additionally, PhRMA is requesting funding to cover loans which would “support increased US investments by vendors and suppliers including those involved in key starting materials.”

Mexico

The Mexican government has sought, through mechanisms such as the US-Mexico High-Level Economic Dialogue and domestic programs, to create a favorable environment for investment in key sectors and to take advantage of the recent trend in nearshoring. Economy Secretary Raquel Buenrostro explained during a Wilson Center seminar that the Mexican government seeks to work with the API manufacturers and entrepreneurs to establish API manufacturing facilities in Mexico to replace imports from China. Mexican efforts to promote investment have at times been undercut by public comments made by President López Obrador and by other challenges to investing in Mexico. Land grants or discounts, tax deductions, and technology, innovation, and workforce development funding are common incentives. State level incentives are also available; the Invest in Mexico Business Center, established in 2022, is a 9-state initiative to facilitate investments.

Other incentives the Mexican government has used to encourage general foreign investment include:

- Special Economic Zones (SEZs), created to attract investment to the underdeveloped areas in the southern states of the country such as Oaxaca and Veracruz. Companies setting up in these SEZs receive various incentives, trade facilities, duty-free customs benefits, infrastructure development prerogatives and easier regulatory processes. For example, in May 2023, the López Obrador administration announced incentives such as waiving taxes on rent and value-added taxes for companies who invest in the new industrial parks located in the Inter-Oceanic corridor (also known as the trans-isthmus project). Free trade zones (FTZ), where goods directed to foreign markets can leave Mexico duty free, such as the Northern Border Free Zone established by the López Obrador administration as of January 1, 2019, and the Southern Border Free Zone, which was established in June, 2023

- A refund of the import duty paid on raw materials or finished goods when exported within 12 months of being imported.

- The IMMEX maquiladora program allows foreign manufacturers to import raw materials and components into Mexico tax and duty free, under the condition that 100% of all finished goods are exported out of Mexico within a government mandated timeframe.

- The new certified companies program allows companies to move goods in and out of Mexico quickly and with less paperwork.

Overall Mexico offers a broad range of incentives, the most important of which are duty-deferral programs and incentives covering R&D, capital investment, and employment. Tax benefits for both the northern border region and the poorest southern regions are also widely promoted by the government. Most recently, a mid-October 2023 decree by the López Obrador administration will provide tax incentives such as accelerated depreciation and worker training expenses for investment in ten key sectors including pharmaceuticals. Finally, Mexico has signed onto bilateral investment treaties with more than 35 countries.

It is important to note that Mexico’s generic manufacturers have indicated that increased production would be facilitated most by greater regulatory harmonization, transparency, and expedience rather than seeking additional tax breaks or other financial incentives.

Policy Questions and Considerations

Several public policy questions, some of which are identified below, will need to be addressed by US and Mexican policymakers if they wish to strengthen the regional medicine supply chain.

What is the national security risk posed by dependence on foreign-based suppliers?

Several US Congressional committees have highlighted the national security risk posed by US reliance on foreign-based API sources. The Department of Defense is concerned with its reliance on foreign suppliers within the pharma supply chain and the risk that essential medicines would not be available to military service members in time of need. As a result, there have been calls for establishing a military pharmaceutical and medical device vulnerability working group. Recognizably, decreasing dependence on foreign-based supplies is a prime area where bipartisan agreement is strong and increasing.

How could the United States reduce its dependence on Chinese APIs?

The Biden administration issued an executive order in September 2022 aimed at bolstering US ability to manufacture critical APIs. A March 2023 follow-up report set forth non-binding goals such as producing at least 25% of all the APIs used in US-produced orally administered drugs by 2025. As mentioned previously, the US imports 17% of its APIs from China; however, drug makers do not see a benefit to moving manufacturing to the US, especially when it comes to generic medicines. Lower labor costs may drive drug makers to set up factories outside the US, especially when making medications with low profit margins. As a result, 87% of manufacturing facilities registered with the FDA that make the APIs used in generic products are located outside the US.

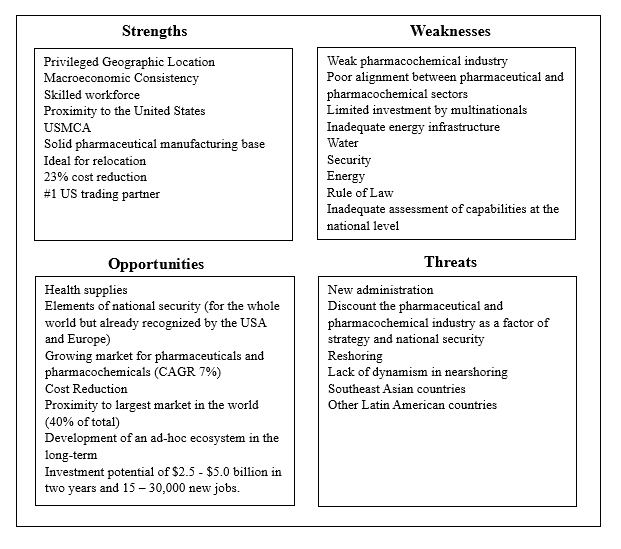

In the areas where China has considerable market share, the US should lessen the risk by identifying alternative sources of supply. Crafting a collaborative US-Mexico strategy for production and distribution of APIs would benefit from a consultative group with representatives of the public, private, nongovernmental, and academic sectors to develop, plan, and execute a mutually beneficial strategy. While industry-specific, measurable actions are indispensable, they will have limited impact if the broader factors impacting business are not mitigated or resolved. For example, Dr. Sergio Ulloa, Scientific Director of Pifarma, has produced strengths, weaknesses, opportunities, and threats (SWOT) analysis facing the pharmaceutical industry in Mexico. (See below). Additionally, the US and Mexican governments should work with industry in both countries to complete an assessment to more clearly understand the extent to which Chinese and Indian supplies can be replaced in the short, medium, and long term.

What is the role/relationship of pricing to greater supply chain resilience?

While the cause of an individual drug shortage is unique, manufacturing complexity, production concentration, and low prices are common factors. One of the most raised concerns, especially among representatives of both countries’ generic drug industry, is cost of production and access to guaranteed purchase contracts. Increasing production by expanding existing facilities or constructing new plants is risky if the investor is not certain there will be a market for their product. Potentially adding to a manufacturer’s uncertainty, under the Veterans Health Care Act of 1992, the sale of medication to the Veterans Administration (VA) is based on the annually adjusted Federal Ceiling Price which guarantees that the VA pays the lowest available price for an indefinite quantity during the contract period. Addressing this concern by issuing guaranteed purchase contracts could provide an important incentive to increased production in the United States or Mexico. Alternatively, the House Select Committee recommends the establishment of a “Buy America” pilot program requiring federally funded health systems to “purchase their pharmaceuticals and basic medical devices and goods only from US production facilities or from allied or likeminded trading partners that have appropriate regulatory certification, with exceptions to guard against shortages.” Incentives such as higher reimbursement rates for US-produced medications should also be considered.

A related consideration is that production in North America could be more costly than production in Asia given the costs of labor and materials and compliance with more stringent environmental regulations. The benefits of increased production, addressed above, may be apparent but would still require a discussion regarding the willingness of major purchasers, especially USG agencies such as Medicare and the Veterans Administration, to pay higher prices.

It is also important to recognize that the least expensive generic drugs tend to be those in short supply while more complex generics and biosimilars are more expensive and thus provide greater pricing flexibility for manufacturers. A 2023 IQVIA study, for example, found that shortages are more common in drugs with very low list prices, with 11% (70 of 631) of drugs priced less than $1.00 per extended unit in shortage, compared to 1.3% (3 of 238) of those priced more than $500 per unit. It may therefore be necessary to provide additional incentives to encourage production of the less expensive but still significantly important products such as oncology medications for which shortages have been increasing. Establishing lists of vulnerable medicines would help to target investment toward products of greatest need/highest risk.

What regulatory changes would facilitate supply chain resilience?

Further harmonization of regulatory standards and requirements between FDA and COFEPRIS would enhance resilience. While unlikely in the immediate term, mutual approvals by FDA and COFEPRIS would provide manufacturers with market access in both countries, and thus provide an important incentive for additional regional production. Mutual recognition would require confidence building measures to establish that each partner’s approval process is equally serious and scientifically rigorous. This is likely more of an issue in the case of FDA willingness to accept COFEPRIS decisions. A first step might be a series of measures regarding facility inspection which could lead to sharing inspection results to make the review process more efficient. A formal dialogue between manufacturers and regulators could yield additional recommendations which would ensure safety while expediting access to market for new medications or manufacturers.

It may also be appropriate to explore ways to guarantee that quality standards are met by producers of APIs and finished medicines. Identifying appropriate public and private bodies and their roles should be a part of such a review.

Building a new chemical manufacturing plant is expensive, time consuming, and regulatory approval timelines are often lengthy and cumbersome. Estimates of the cost to construct a new manufacturing facility vary widely depending on location and the complexity of the products to be produced. The American Chemistry Council puts the average cost of building a new chemical plant in the United States at $1.2 billion. PhRMA estimates that it can take 5-10 years to set up a new manufacturing facility, and even longer to transfer an entire manufacturing network. More specifically, in 2021, Astra-Zeneca announced plans to build a $360 million API facility in Ireland (with cost estimates rising to $400 million by 2023). Approval to move forward with construction, following an environmental impact study, was granted in May 2023, with the facility becoming operational in 2026. In May 2020, the Trump administration awarded Phlow Corp a Biomedical Advanced Research and Development Authority 4-year contract worth $354 million with an option to extend to $812 million over ten years to produce API and generic drugs in the United States. The company received an additional $87 million in 2021. API manufacturing began in April 2024 in the first of two planned facilities.

On the regulatory side, construction of industrial projects in the United States is often delayed due to permitting delays, necessary environmental impact studies, and the involvement of multiple levels of government, among others. While reducing standards, in terms of environment, health or safety, would be counterproductive, the US and Mexican governments should streamline procedures to allow for more rapid and predictable timelines. Meanwhile, Mexico is pushing toward a new regulatory path meant to both assure that more Mexicans have access to the products they need, and to establish the country as a regional producer of biosimilars.

Conclusion

The COVID-19 pandemic focused global attention on the risks of relying on a single country or manufacturer for vital products and inputs such as semiconductors or critical minerals essential to our economies and societies. The need for reliable access to safe, high-quality pharmaceuticals is no less important to our national wellbeing. Shortages of medicines due to supply chain interruptions and excessive dependence on single manufacturers create national security challenges for the United States and for Mexico. Replacing Chinese and Indian production is not possible in the short or medium term, and moving the locus of dependence to single facilities in North America would be no more advisable. Yet, there is little doubt that increasing the diversity of the manufacture and supply of API and finished pharmaceuticals would enhance our security.

It would be wise for our governments, working with industry and other interested stakeholders, to conduct a comprehensive market analysis of the products for which we are most vulnerable to ensure that efforts to enhance supply chain predictability are directed to those products (API and/or finished medications) for which need is greatest and for which access is most precarious. The US Pharmacopeia’s Medicine Supply Map is an important tool that could be further strengthened by governmental support for data collection.

Following completion of this needs assessment, the US and Mexican governments should provide appropriate incentives and streamlined procedures to capitalize on existing manufacturing capability and know-how to increase North American production. Recognizing the substantial investment required to build a new facility and the lengthy timeline from the first shovel in the ground to the initiation of commercial production, governments should consider tax benefits, guaranteed purchasing contracts at economically feasible prices, streamlined approval and inspection processes for the construction and oversight of completed facilities, and other assistance. The objective is not to reduce the safety of medications but to ensure that oversight is conducted as efficiently as possible to incentivize investment.

In sum, the US and Mexican governments, having learned the supply chain lessons of the COVID-19 pandemic, need to apply these lessons to pharmaceuticals so that their citizens have access to the medications needed to live healthy and productive lives, and that our supply chains are strengthened and diversified prior to the next pandemic.

Authors

Professor of International Business and Executive Director for the Americas, College of Business, Florida International University

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more

Explore More

Browse Insights & Analysis

Mexico’s Historic Elections—and Political Violence

Trends and Opportunities in Mexico-US Pharma Trade