Most US Fresh Cucumbers are Imported from Mexico

Leo Pakhomov, Shutterstock

Cucumbers (Cucumis sativus) are the cylindrical fruits of creeping vine plants consumed as vegetables. Cucumbers are 95 percent water, and there are two major types: fresh cucumbers up to 10 inches long and with thick skins that are peeled and sliced and shorter and fatter cucumbers that are pickled with brine, sugar and vinegar.

Some fresh cucumbers are “burpless” with thinner skins and fewer seeds whose skins do not have to be peeled; eating them leads to less excess gas or burping than thick-skinned fresh cucumbers. Americans consume about 12 pounds of cucumbers per person per year and are switching from thick-skinned to thin-skinned burpless varieties.

Growers in the southeastern states produce mostly thick-skinned fresh cucumbers in open fields. Many U.S. growers have complained about unfair competition from imported Mexican thin-skinned burpless cucumbers, most of which are grown under cover, prompting a United States International Trade Commission (USITC) investigation. The USITC emphasized that consumers prefer the imported burpless thin-skilled varieties even though they are more expensive than US-produced thick-skinned cucumbers.

The fresh cucumber story is similar to fresh tomatoes. Americans prefer vine-ripened Mexican-grown tomatoes from protective structures to US mature-green tomatoes grown in open fields. About 60 percent of US fresh tomatoes and 60 percent of fresh cucumbers, are imported.

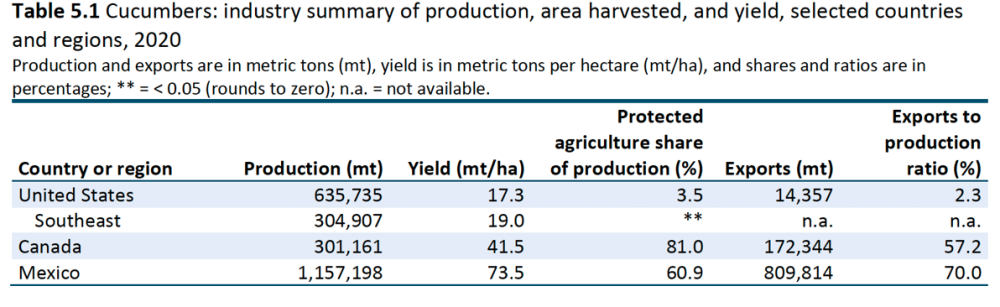

Production. China produced most of the world’s 158 million tons of cucumbers in 2020, followed by Turkey, Russia, Ukraine, and Iran. Mexico is the seventh largest cucumber producer and the leading exporter, accounting for 30 percent of global fresh cucumber exports. The US accounts for 36 percent of global fresh cucumber imports.

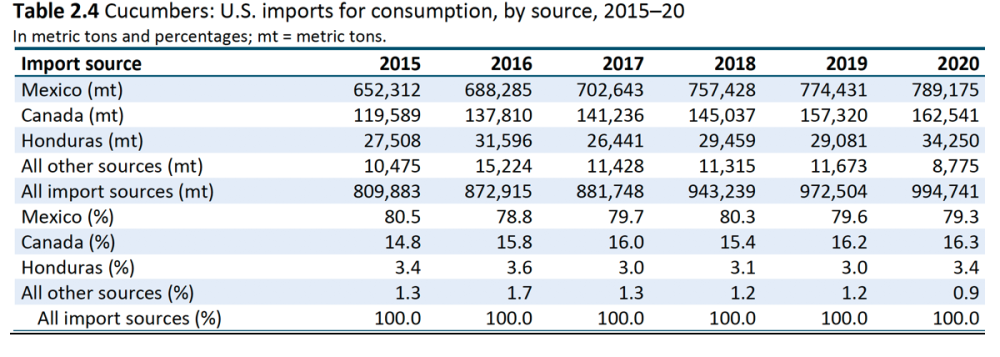

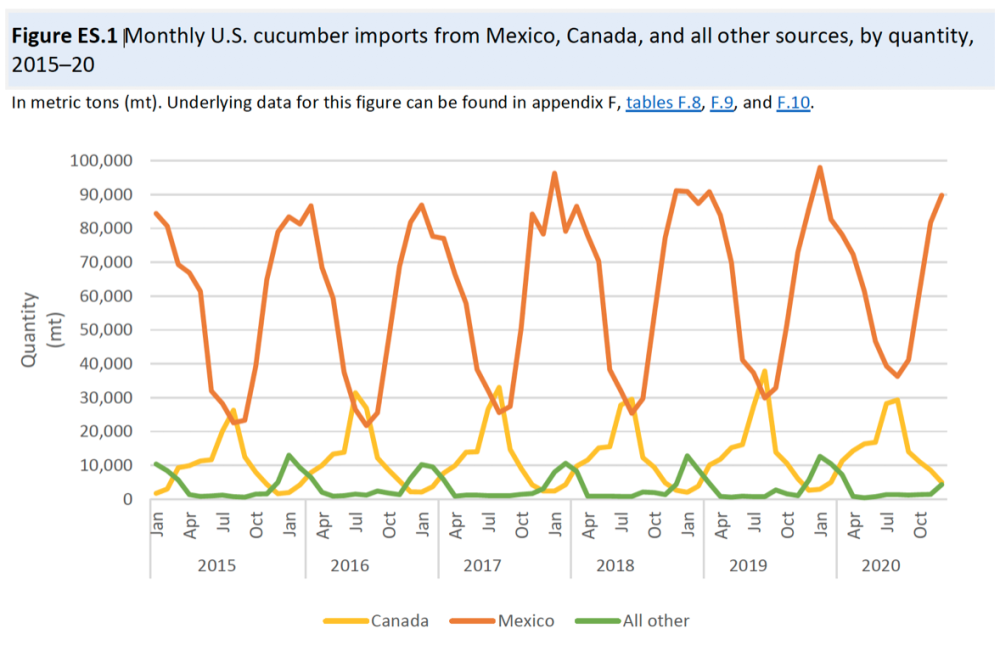

The US consumes 1.6 million metric tons of cucumbers each year and produces 636,000 tons, making imports almost a million tons and over 60 percent of the cucumber supply. Mexico exports about 800,000 tons of fresh cucumbers to the US, most between November and May, while Canada exports 200,000 tons, most between March and October.

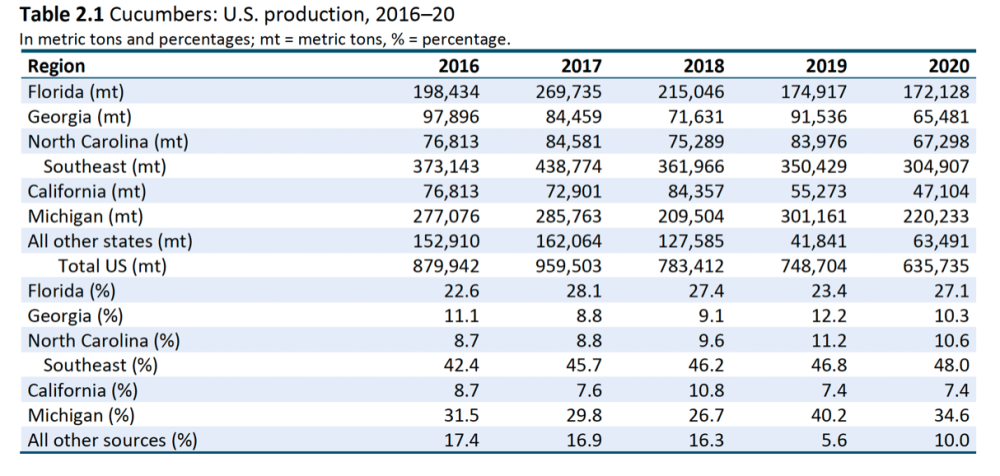

Most US cucumbers are produced in open fields. Michigan growers specialize in pickling cucumbers that are harvested by machine, while growers in Florida, Georgia, and North Carolina specialize in fresh or slicing cucumbers that are picked by hand. Southeastern states produced 305,000 tons of cucumbers in 2020, and southeastern, growers complained that Mexican cucumber imports adversely affected them.

The USITC characterized southeastern US cucumbers as high cost, medium differentiated, and available with medium reliability, while cucumber imports from Mexico were described as medium cost but with high product differentiation and high reliability of supply due to the use of controlled environment agriculture or protected agriculture structures that protect growing plants. Canada is a high-cost producer of highly differentiated cucumbers.

Most US fresh cucumbers are from Canada and Mexico, which produce them in Controlled Environment Agriculture (CEA) and export most of their production to the US. Yields are far higher in CEA greenhouses and other protective structures where the thin-skinned burpless varieties desired by Americans generate much higher yields than the thicker-skinned varieties produced in open fields in the southeastern states.

Canada exports 57%, and Mexico 70%, of the cucumbers produced.

Philip Martin

Farmers in the southeastern states, many of whom also grow tomatoes and bell peppers, produce mostly slicing or fresh cucumbers in open fields and pick them by hand. US cucumber acreage is shrinking, and was 37,000 in 2020, including 14,000 acres in Michigan and 8,400 acres in Florida. Yields range from 16 tons an acre in Michigan to 21 tons an acre in Florida.

Florida is the leading US producer of fresh and Michigan the leading US producer of pickling cucumbers.

Philip Martin

Southeastern producers plant seeds in raised beds covered with plastic with holes for the plants, and use drip irrigation to ensure that plants are watered and fertilized. Cucumbers are harvested by hand, and washed, graded, and packed before being cooled and shipped. Labor for pre-harvest and harvesting tasks represents a third of production costs.

Most cucumbers in southeastern states are harvested by H-2A workers from Mexico. The southeastern states have the highest share of farm jobs certified to be filled by H-2A workers and the lowest Adverse Effect Wage Rates among states:

- A 2022 FL H-2A job order (JFT Harvesting) offered $0.50 to pick a 5/8 bushel of fresh or long cucumbers; workers must pick over 24 bushels an hour to earn the $12.08 Florida AEWR

- FL’s Indian-Okee Harvesting offered $0.55 a bucket in 2022, setting a productivity standard of 22 buckets an hour.

- A SC H-2A job order (Fann Farms) offered $0.75 for each 5/8 bushel of pickling cucumbers, which must be less than two inches in diameter. Harvesters must pick 18 bushels an hour to earn the $13.15 AEWR while discarding thicker cucumbers in the middle of the row.

Trade. The US imports a million tons of cucumbers a year, over 60 percent of consumption. Mexico supplies 80 percent of US cucumber imports, followed by 16 percent from Canada. Over 90 percent of fresh market cucumbers produced in Mexico are exported.

Mexico supplies 80% of US cucumber imports.

Philip Martin

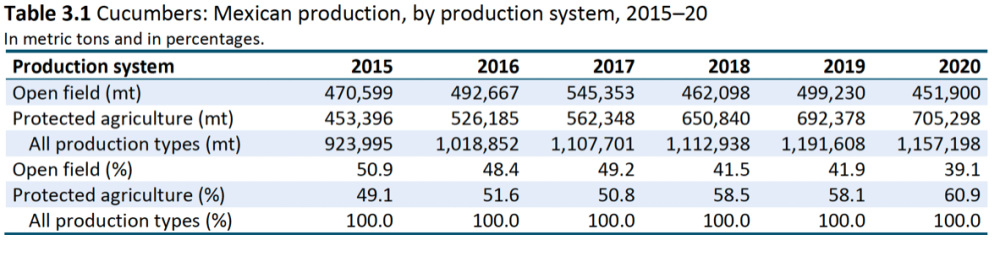

Over half of Mexican cucumbers are from Sinaloa and Sonora, and 60 percent are from some form of CEA, including shade houses and greenhouses that protect growing plants. CEA requires more upfront investment, up to $45,000 per hectare for shade houses and $1 million per hectare for glass greenhouses, but increases the reliability of supply, reduces the need for pesticides, and facilitates organic production. Yields are much higher with CEA, 155 tons per hectare in 2020 versus 40 tons per hectare in open fields. CEA cucumbers are grown on less than 30 percent of Mexican acreage devoted to the crop, but generate 60 percent of Mexican cucumber production.

Over 60% of Mexican cucumbers are produced in CEA.

Philip Martin

Low Mexican wages and good transport links to the US make Mexico a low-cost and reliable supplier of cucumbers year round, although US imports of fresh Mexican cucumbers peak in December-January. The share of burpless cucumbers imported from Mexico is increasing alongside the share of cucumbers from CEA. Between 2015 and 2020, about 55 percent of Mexican CEA area was used to grow tomatoes, 13 percent for peppers, and 11 percent for cucumbers, with much the rest used for berries.

Cucumber imports from Mexico peak in the winter months.

Philip Martin

There are limited data on production costs for Mexican cucumber farms. The USITC noted that most cucumber exports to the US are from large farms that may also grow tomatoes and bell peppers for export, and that 40 export-oriented tomato farms in Sinaloa have an average 640 hectares or almost 1,600 acres each, sometimes spread over several farms. Cucumber vines are usually trained to grow on trellises in Mexico, picked by hand, and taken to packing sheds for cooling, washing, and packing. Erecting trellises can be semi-automated in CEA structures.

The USITC could not obtain the labor cost share of production costs in Mexico, but assumed that labor’s share was similar to the 30 percent labor share of production costs in asparagus in open fields and the 25 percent labor share of production costs in green house tomatoes. Fertilizer is 40 percent of production costs in green house tomatoes, higher than labor costs.

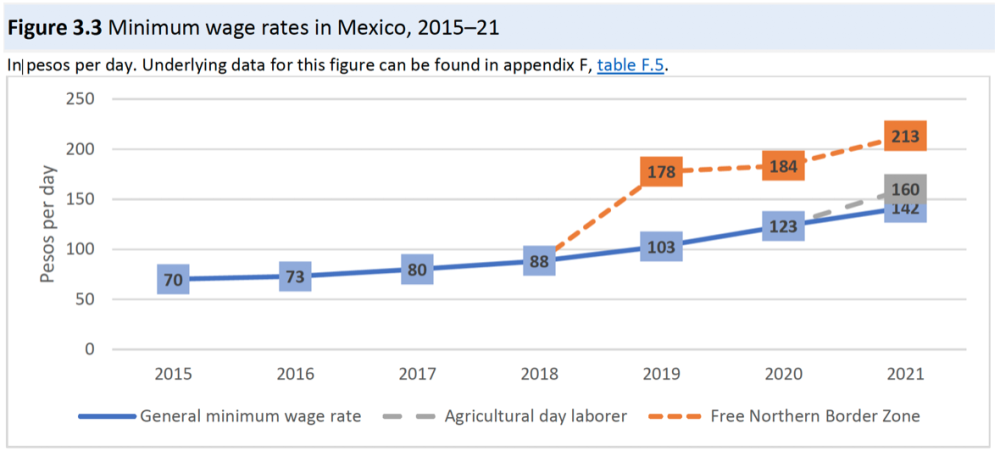

Mexico’s minimum wage rose 76 percent between 2015 and 2020 to 123 pesos or over $6 a day, and a higher minimum wage of 160 pesos or $8 a day applies in border areas. Lower wages in Mexico allow growers to trellis cucumber vines and pick cucumbers more often.

Mexico’s minimum wage increased 76% between 2015 and 2020.

Philip Martin

Most workers employed on farms that export fresh produce to the US earn more than the minimum wage, $10 to $12 a day in 2021 and $15 to $20 a day when harvesting for piece rate wages in periods of high yields.

Mexico’s competitive advantages include widespread use of CEA, lower labor costs, and an arid climate that reduces pest and disease pressures. Sinaloa growers have fewer rain and freeze risks than growers in the southeastern US states, and growing cucumbers in CEA reduces food safety risks.

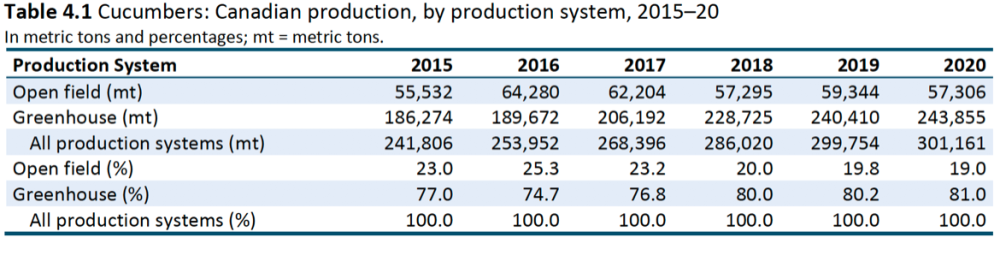

Canada: Canada is a high-cost and high-tech supplier of differentiated fresh cucumbers such as burpless English and Persian varieties. Over 80 percent of Canadian cucumbers are from high-tech greenhouses, which increases yields to 50 metric tons per hectare and makes supplies more reliable. Seedlings are planted, and production is concentrated in the summer months when there are long hours of sunlight.

Most of Canada’s greenhouse-grown cucumbers are burpless varieties.

Philip Martin

Canadians consume less than five kg of cucumbers per person per year, so 55 percent of cucumbers produced in Canada are exported. Most growers are small, but there are at least three large producers, Mastronardi Produce, Red Sun Farms, and Nature Fresh, that often have packing operations adjacent to greenhouses.

Labor is about 30 percent of production costs for vegetables grown in greenhouses. Cucumber vines are trained to grow on vertical trellises, and workers stand on lifting devices to tie the vines and harvest the cucumbers as often as every day during the peak season.

Most of the workers employed in Canadian greenhouses are guest workers from Mexico and the Caribbean (Jamaica) admitted under the Seasonal Agricultural Worker Program (SAWP), which permits farm guest workers to stay in Canada up to eight months a year. The SAWP is similar to the US H-2A program, with farm employers required to demonstrate that local workers are not available, to cover most worker transportation costs, and to provide housing at no cost to guest workers. Ontario’s minimum wage rose from C$14.25 ($11.35) to C$15 ($12) on January 1, 2022.

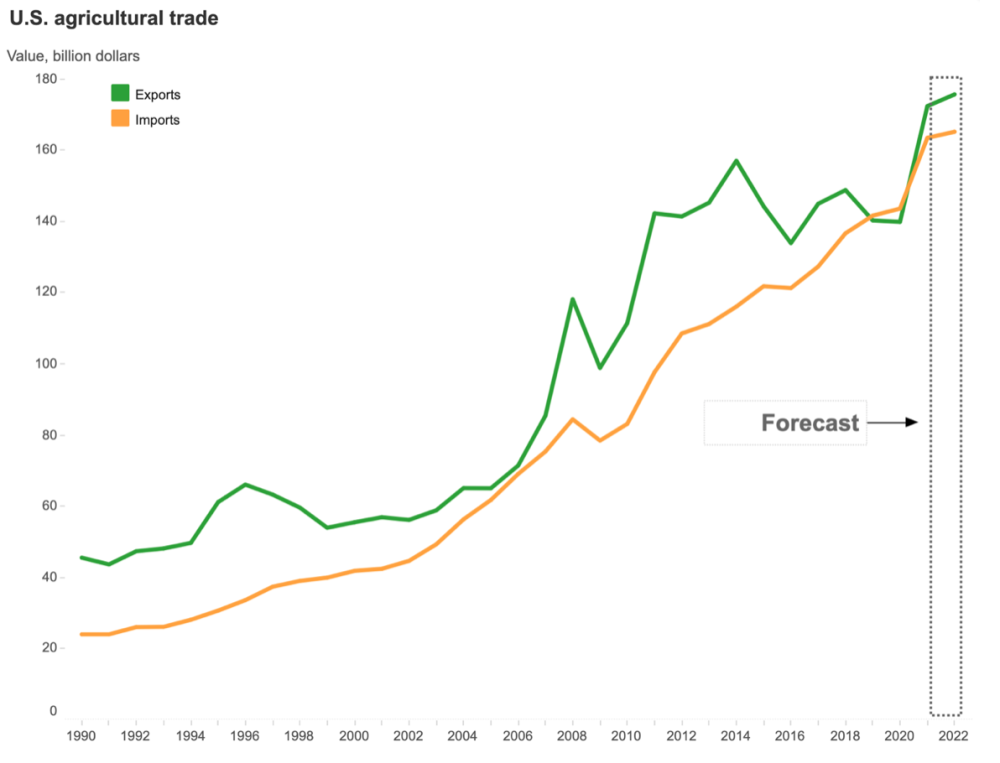

Perspective: The US has had an agricultural trade surplus since 1960. In recent years, about 40 percent of US farm commodities by value have been exported, making most US farmers free traders who want to open markets for corn, soybeans, and meat and dairy products in China and other countries.

The US has had an agricultural trade surplus since 1960; about 40% of US farm commodities by value are exported.

Philip Martin

A prominent exception to US agriculture’s free trade stance has been Florida and the southeastern states that produce during the winter and early spring months. Fruit and vegetable production expanded in Florida after the US embargo of imports from Cuba in 1962, and US policies that restrict sugar and orange juice imports have maintained these crops in Florida.

Declining cotton and tobacco acreage in southeastern states and warmer temperatures encouraged more production of fresh fruits and vegetables. New varieties of blueberries that require fewer winter chilling hours allowed growers in Florida and Georgia to expand production alongside more acres of cucumbers, peppers, and squash.

Rising production in the southeastern states collided with rising imports from Canada and Mexico, prompting efforts to restrict imports early in the season when prices are highest for US growers. The longest-running dispute between US and Mexican producers involves fresh tomatoes, which are grown in southern Florida and imported from Mexico during the winter months. Florida growers accused Mexican growers of dumping their tomatoes in the US at below their cost of production, and suspended their effort to impose tariffs on imported Mexican tomatoes if imports were sold in the US at more than a minimum or reference price.

The tomato case illustrates a major feature of the trade complaints brought by southeastern growers against imports from Mexico. The US-produced commodity often involves open-field production of varieties that are losing favor with consumers, while the imports from Mexico are often the varieties preferred by consumers and grown under CEA structures.

Fresh cucumbers in North America are mostly picked by Mexican-born workers. The workers employed in Mexican CEA farms are mostly local and internal migrants who earn two or three times the Mexican minimum wage. The workers employed in US open fields and Canadian CEA farms are mostly Mexican guest workers who earn slightly more than the minimum wage. Even though the Adverse Effect Wage Rates (AEWRs) that must be paid to US guest workers are among the lowest in the US, southeastern growers complain that they cannot compete with Mexican imports.

2022 AEWRs in FL, GA, and NC are among the lowest in the US.

United States Department of Agriculture

Given the swing-state status of the southeastern states in US politics, there are likely to be more complaints about unfair imports of fresh commodities from Mexico and other countries. However, the spread of CEA production abroad is making imported fruits and vegetables different from US production of fresh tomatoes and cucumbers. If fruits and vegetables from CEA facilities are recognized as different from open-field production, as Naturesweet has requested for CEA-grown cherry tomatoes, complaints against fresh produce imports may diminish.

Most imported cucumbers are thin-skinned varieties that do not have to be peeled.

271 EAK MOTO, Shutterstock

o

About the Author

Philip Martin

Mexico Institute

The Mexico Institute seeks to improve understanding, communication, and cooperation between Mexico and the United States by promoting original research, encouraging public discussion, and proposing policy options for enhancing the bilateral relationship. A binational Advisory Board, chaired by Luis Téllez and Earl Anthony Wayne, oversees the work of the Mexico Institute. Read more